Cash margin formula

Below is the calculation formula. When you deposit 1600 of cash into your account your new account balance consists of 3600 of cash and 8400 of margin.

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash conversion cycle used to know the liquidity issues as well as excess inventory on hand.

. The basic breakeven model for calculating the margin of Safety can be. Relevance and Uses of Cash Conversion Cycle Formula. 6 to 30 characters long.

Free Cash Flow Formula in Excel With excel template Here we will do the example of the Free Cash Flow Formula in Excel. In other words the operating margin ratio demonstrates how much revenues are left over after all the variable or operating costs have been paid. Net Profit margin Net Profit Total revenue x 100.

Ltd manufacture plastic boxes company has its net income of 45000 total non-cash expenses of the company are 10000 and changes in working capital is 2000. By selling stocks you decrease the amount of margin therefore increase the percentage of the equity. He was inexperienced in the business and he feels he has made adequate sales to recover from loss and appears to be making a profit.

There are two applications to define the margin of safety. Must contain at least 4 different symbols. This formula shows the total number of sales above the breakeven point.

You can easily calculate the Free Cash Flow using the Formula in the template provided. Calculating the Margin of Safety in percentage. Cash Reserve Ratio CRR is the rate based on which the central banks decide on the cash reserve requirements that commercial banks need to fulfill.

Get 247 customer support help when you place a homework help service order with us. This can be an indicator of proof sales or even worse a. In the United States the Federal Reserve sets the CRR for the American banks.

Then the user needs to find the difference between the maximum and the minimum value in the data set. Profit Margin 10 Profit Margin Formula Example 2. Value Min needs to be determined.

Cash Flow 30000 - 5000 - 5000 50000 70000. From the data the user needs to find the Maximum and the minimum value in order to determine the outliners of the data set. Operating Cash Flow Margin.

Understanding Margin of Safety. Operating Activities includes cash received from Sales cash expenses paid for direct costs as well as payment is done for funding working capital. FCF represents the cash that a company.

Cash flow is the net amount of cash and cash-equivalents moving into and out of a business. As of October 3 2017 the company had 218 million in current assets and 384 million in current liabilities for a negative working capital balance of -166 million. Typically expressed as a percentage net profit margins show how much of each dollar collected by a.

When the company has to sell off its assets then the cash generated from the sale will first go to the lenders creditors and other stakeholders then the common stockholders are paid if anything is. By depositing funds you decrease the amount of margin and increase your equity. Current Ratio and Quick Ratio.

Free Cash Flow Formula. Read more per unit revenue can be more precise in this context. The result of the profit margin calculation is a percentage for example a 10 profit margin means for each 1 of revenue the company earns 010 in net profit.

If those margins were say 10 it would indicate that the startups had profitability as well as cash flow problems. Here we will learn how to calculate Common Stock with examples Calculator and downloadable excel template. The margin of Safety in percentage 20.

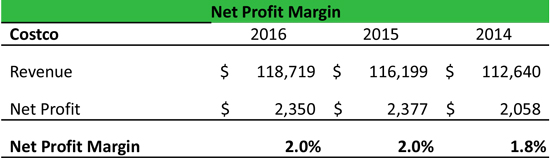

Net Profit Margin Formula. Net profit is calculated by deducting all company expenses from its total revenue. Cash conversion cycle that attempt to measure the time it takes a company to convert its inventory and other resources inputs into cash.

The operating cash flow can be found on the. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Net profit margin is the ratio of net profits to revenues for a company or business segment.

You need to provide the three inputs ie. It is the leftover money after accounting for your capital expenditure and other operating expenses. Positive cash flow indicates that a companys liquid assets are increasing enabling it to settle debts.

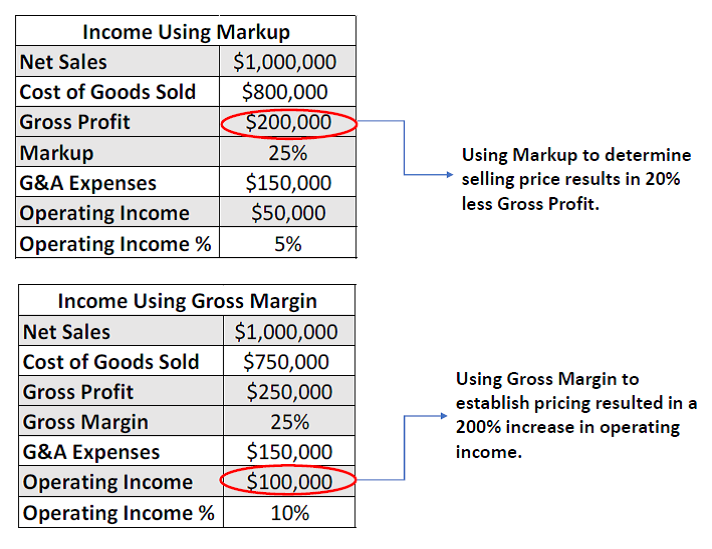

As a working capital example heres the balance sheet of Noodles Company a fast-casual restaurant chain. While a cash flow statement shows the cash inflow and outflow of a business free cash flow is a companys disposable income or cash at hand. Gross Margin 38.

The formula for operating cash flow can be derived by using the following steps. The normalization formula can be explained in the following below steps. Gautam has started a new business in the gym around a year ago.

Free cash flow FCF is a measure of a companys financial performance calculated as operating cash flow minus capital expenditures. Free Cash Flow - FCF. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales.

2 Removes Non-Operating Effects. In other words the total number of sales dollars that can be lost before the company loses money. The operating margin ratio also known as the operating profit margin is a profitability ratio that measures what percentage of total revenues is made up by operating income.

The margin of safety is the difference between the amount of expected profitability and the break-even point. EBITDA margin calculation removes nonoperating effects that are unique to each company. The margin of safety formula is calculated by subtracting the break-even sales from the budgeted or projected sales.

For the year ended. ASCII characters only characters found on a standard US keyboard. Operating Cash Flow Capital Expenditure and Net Working Capital.

For the startup example above both would have a 60 EBITDA margin 300000 500000. The gross margin equation expresses the percentage of gross profit Percentage Of Gross Profit Gross profit percentage is used by the management investors and financial analysts to know the economic health and profitability of the company after accounting for the cost of sales. Guide to Common Stock Formula.

Cash Flow from Operations Formula Example 1. A good EBITDA margin varies by industry but a 60 margin in most industries would be a good sign. When the banks across the nation held the reserve portion of cash it becomes inaccessible to them.

It is the income generated from the business before paying off interest and taxes. A company named Neno Plastic Pvt. Gross Margin Formula Example 2.

It is very easy and simple. Firstly determine the operating income of the company from the income statement. The margin of safety formula is equal to current sales minus the breakeven point divided by current sales.

Margin of safety in percentage 12000 unit 10000 unit12000 unit 100.

Profit Margin Formula And Ratio Calculator

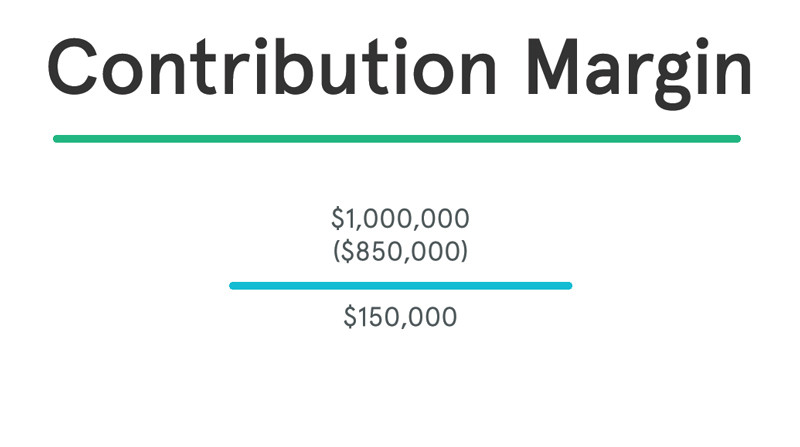

Contribution Margin Ratio Formula Per Unit Example Calculation

Operating Cash Flow Margin Formula And Calculator

How Does Gross Margin And Net Margin Differ

Summary Of Economic Margin Obrycki Resendes Abstract

Net Profit Margin Formula Example Calculation

Gross Margin Vs Markup Cogent Analytics

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Operating Cash Flow Margin Formula Calculator Updated 2022

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Margin Formula And Calculator

This Week Its Accounting Theory Ppt Download

Cash Flow Ratio Analysis Double Entry Bookkeeping

Economic Margin Value Expectations

Defining A Good Fcf Margin Formula Basics Examples And Analysis

Operating Cash Flow Margin Formula And Calculator

Net Profit Margin Formula And Ratio Calculator